# 1 choice for accounting, audit, tax, consulting and analytic services

Bridgers, Goodman, Baird & Clarke not only to help you manage and grow your business, but to help you achieve your business and personal financial goals, so that your business can be a means to enjoy all of your life’s passions.

Over 40 Years of Quality Service in Certified Public Accounting

We are committed to providing close, personal attention to our clients. We take pride in giving you the assurance that the personal assistance you receive comes from years of advanced training, technical experience and financial acumen

Services

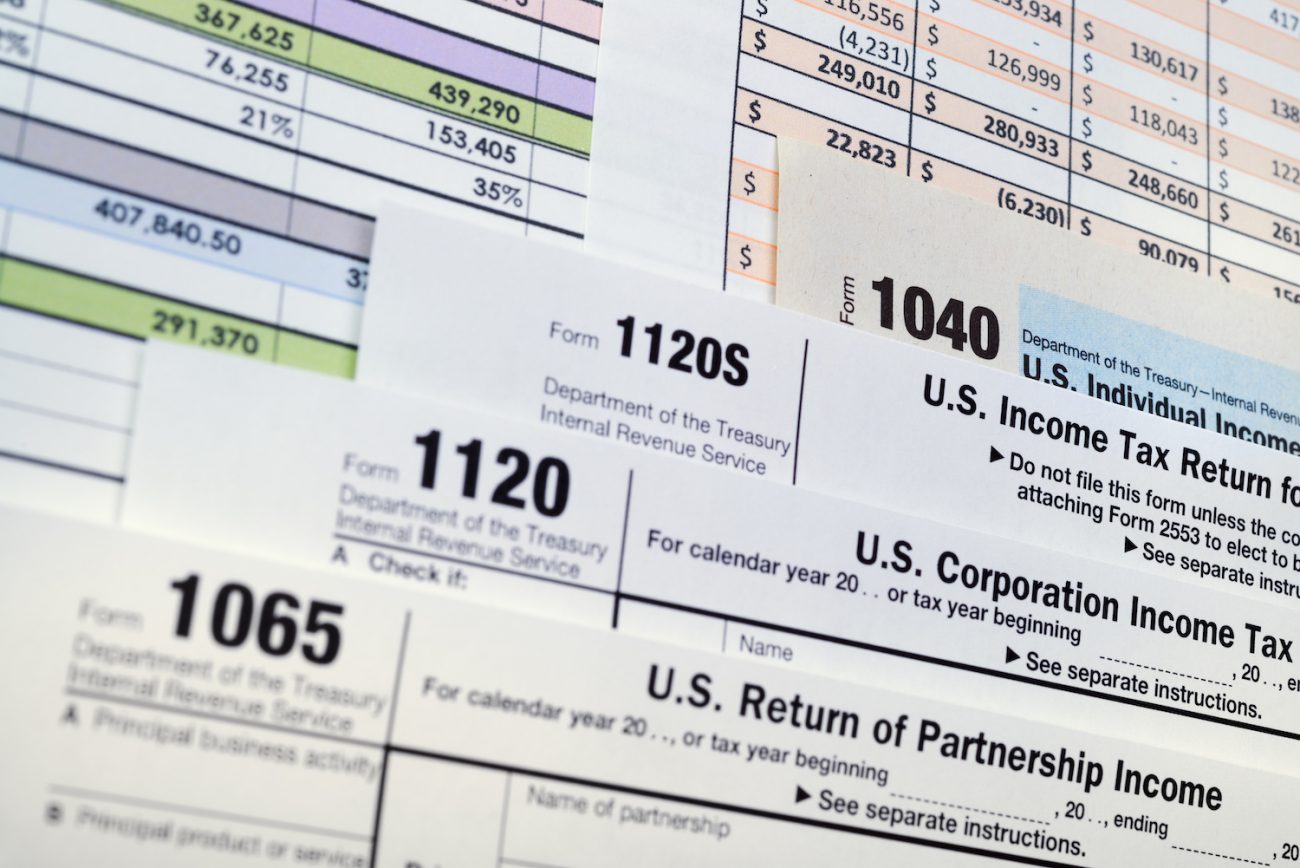

Tax Services

We assist our tax clients through efficient compliance and effective planning to help them realize substantial savings.

Auditing & Assurance

Our goal is to improve information or the context of information so that decision makers can make more informed, and presumably better, decisions.

Business Services

Bridgers is the perfect choice for your small business

We provide more than accounting and bookkeeping services; we take an active role in increasing profits for your business. We’ll deliver the accurate financial reports you need to watch expenses and the inventive strategies to manage your tax obligations. At Bridgers CPAs, we know that how you handle your money can make or break your business.

Business Services Experts

Certified Public Accountants

Let us do your Accounting

Spend More Time Doing What You Love

By allowing Bridgers CPA’s to take care of your Accounting needs you can spend more time focusing on your business.

What you need to Know About

Auditing and Assurance

What is Auditing and Assurance

Why do I need a tax accountant?

Preparing for an Audit?

- All

- Blog

- Blog Posts

- Financial Planning

- General Business News

- Tax and Financial News

- Tip of the Month

- What's New in Technology

- Blog ·

What Families Need to Know About the New Trump Accounts

- Bridgers CPAs·

- January 1, 2026 12:00 pm·

- 0·

- Blog ·

Defining An Activity Cost Driver

- Bridgers CPAs·

- January 1, 2026 12:00 pm·

- 0·

- Blog ·

What Seniors Actually Got in the Latest Tax Bill

- Bridgers CPAs·

- January 1, 2026 12:00 pm·

- 0·

- Blog ·

Passive Income 101

- Bridgers CPAs·

- January 1, 2026 12:00 pm·

- 0·

- Blog ·

What Frictionless WebAR Means for Creators, Brands and Small Businesses

- Bridgers CPAs·

- January 1, 2026 12:00 pm·

- 0·

Client Access

- Randy·

- February 7, 2019 9:36 pm·

- 0·